What should participants of traditional financial systems do when they need to take a loan? They go to a bank, submit an application where it is important to define the aim of taking this money, and in case of a positive decision from the bank, these people will get the desired amount.

The received sum must be returned to the bank with a certain interest within a set time period. Terms, as well as interest rates, depend on the type of loan that you want to take (for example, it can be a home loan, a business loan, a persona loan, etc.), your credit history, the bank that you’ve chosen and many other factors. Yes, you get the desired amount but the main beneficiary is still the bank that will get the set interest.

However, in the world of DeFi everything works in another way.

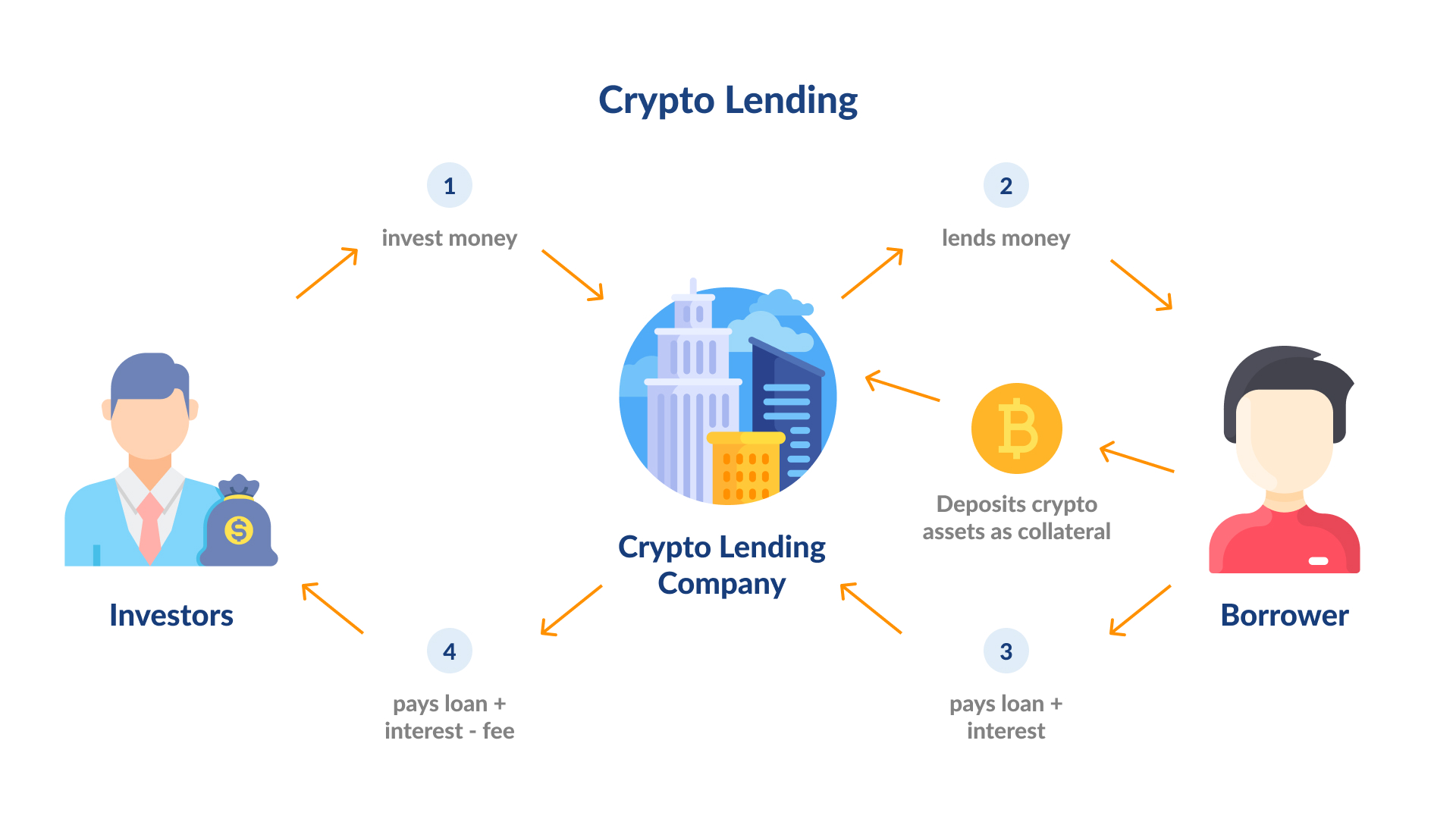

DeFi lending platforms play a similar role to the role of traditional banks. But unlike, traditional systems, the DeFi space offers the possibilities to all the participants to enjoy the benefits.

Absolutely anyone can use blockchain-powered lending solutions to receive loans (or provide loans to others) without any intermediaries.

If you have some available assets, you can enlist them on such platforms so that a borrower will be able to take a loan directly without the participation of banks or other intermediaries. You may ask why you should offer your funds for lending purposes. Actually, it’s not your obligation:) However, doing that you will earn interest just like a bank in the traditional financial system.

The model is quite similar to p2p lending. However, it has some distinguishing peculiarities. And the main one is that crypto lending presupposes collaterals that a borrower has to pledge. Collaterals act as a guarantee that a borrower will repay the loan. If a borrower doesn’t do that, a lender can sell this crypto and avoid losses.

As you may have already guessed, DeFi platforms are powered by blockchain technology which has a lot of benefits for all the participants of the modern financial system.

What are they?

Advantages of DeFi lending

- Accessibility. Crypto loans do not presuppose the involvement of intermediaries and provide borrowers with much easier access to funds.

- High speed and great flexibility. To take a loan, a person does not need to go to a bank, prepare dozens of papers and wait for the approval. The key thing that a person has to do if he or she wants to take a crypto loan is to create a crypto wallet and an account on the DeFi platform. All this can take just a couple of minutes.

- Transparency and immutability. That’s one of the key characteristics of blockchain. All transactions are kept in the network and remain altered forever and everyone can verify them. So, it is possible to track any fund movement.

- Lower barriers. To take a loan on a DeFi platform, you do not need to have a good credit rating and to reveal your credit history to prove your creditworthiness.

But as usual, every coin has two sides.

Disadvantages of DeFi lending

- High interest rates. The rates in the crypto space are rather high at the moment (which is good for lenders but bad for borrowers) and can reach up to 17-20%. However, let’s not forget that in some countries traditional banks also set such or even higher rates.

- Immaturity. Blockchain-powered solutions have entered the game not so long ago and many of them still can’t boast for their stable functioning. If the blockchain that hosts a platform experiences some stability issues, they will be inherited by platforms.

- Risks of fraud. Though the security standards in the crypto industry have increased over the years, there is still some space for improvements. Moreover, in the DeFi industry, insurance that can protect investors in the case of hacks or some illegal activities from the side of fraudsters is a very rare thing.

- Overcollateralization. The high volatility of cryptocurrencies leads to the necessity to take collaterals that are worth significantly more than the amount required for covering potential losses in the case of unpaid loans. DeFi platforms can require collaterals that are 150% more than the borrowed amount itself.

Crypto loans: How both lenders and borrowers can earn?

DeFi lendng platforms are always mutually beneficial for all parties. They allow borrowers to get funds quickly and easily, while lenders can earn interest on their money, But that’s not the end of earning opportunities. Some other options include:

- Arbitrage between centralized exchanges (CEXs) and decentralized exchanges (DEXs). You can take a loan in fiat currencies at a lower rate in comparison to what decentralized platforms offer. Then you can buy crypto for this fiat on a CEX and then lend this crypto on a DEX with a higher interest rate and earn an arbitrage fee.

- Margin trading. You can take a loan in crypto on a DeFi platform and trade it for any other crypto asset on another platform.

Though these options provide great chances for earning money, we’d like to warn you that crypto trading activities and investments are associated with high risks, that’s why, please, always try to be as attentive as possible when you tale investment decisions.

DeFi lending platforms

AAVE

This Ethreum-based protocol offers a wide range of services but lending is among the most highly demanded ones. It has a dual token model: a governance token dubbed LEND and an ERC-20 token aToken which is used for paying rewards to lenders. Aave is a DeFi platform with one of the widest range of assets supported. This range includes Ethereum (ETH), Tether (USDT), USD Coin (USDC), 0x (ZRX), ChainLink (LINK) and many others.

Venus

It is one of the most popular marketplaces on the Binance Smart Chain (BSC). It provides users with a simple way to lend and borrow stablecoins. Venus has the VAI stablecoin that is collateralized by other stablecoins and is not pegged to fiat.

On Venus, assets can be tokenized into vTokens. If users hold these tokens, they can borrow funds with no fees.

Compound Finance, MakerDAO, dYdX, Torque, Oasis Borrow are among other popular DeFi lending solutions. We’ve already talked about some of them in our blog. You can read about them here.

The DeFi space is quickly expanding and if you also have an idea for a new DeFi project, it is high time to think about its realization. Our experts are always at your service and are ready to help you with bringing to life even the boldest ideas. Just contact us!