While blockchain is widely associated with Bitcoin, it is far not the only use case of this emerging technology. There are many other phenomena in the crypto-related space and one of them is something that you should definitely consider if you are interested in finance. Actually, let’s be honest, we all work and get salaries as we all need money to survive, so, to varying degrees we all are interested in finance. That’s why this article is for you.

Now we have another notion for consideration. It is DeFi or decentralized finance.

Is it really a new form of a financial system that we will have in a couple of years or a couple of decades? And if yes, isn’t it too late for your business to enter this sphere and to benefit from it? We are here to help you to answer these questions.

DeFi: What is it?

DeFi represents itself an ecosystem of blockchain-powered financial products that are aimed at expanding the capabilities of traditional finance institutions and bringing them to a completely new level. On one hand, we can say that this rapidly growing ecosystem has come to be the opposite of what we have now in the sphere of finance. On the other hand, it’s important to understand that DeFi is here to revolutionize today’s system.

What is so special about the decentralization of finance? Today all the financial institutions like banks, payment processors, and others are centralized. The new concept presupposes the implementation of mechanisms and processes that won’t be governed by a central authority.

What happens now when you want to transfer money to your friend or parents? In this transaction, the following institutions participate: your bank, the second bank, the services of which the receiver of money uses, a payment system and a gateway provider. Do you imagine how complicated the process is and how many risks are involved?

But if we look at a decentralized version of just the same process, we will see how easily everything can be organized. Your digital wallet can interact with the second digital wallet directly.

The verification of your transaction will take place on a distributed ledger without the involvement of any external organizations. These p2p (peer-to-peer) transactions are the most popular example of the capacities of DeFi but not the only one. If you want to learn more about the most popular DeFi apps, we recommend reading this post prepared by the Omertex team.

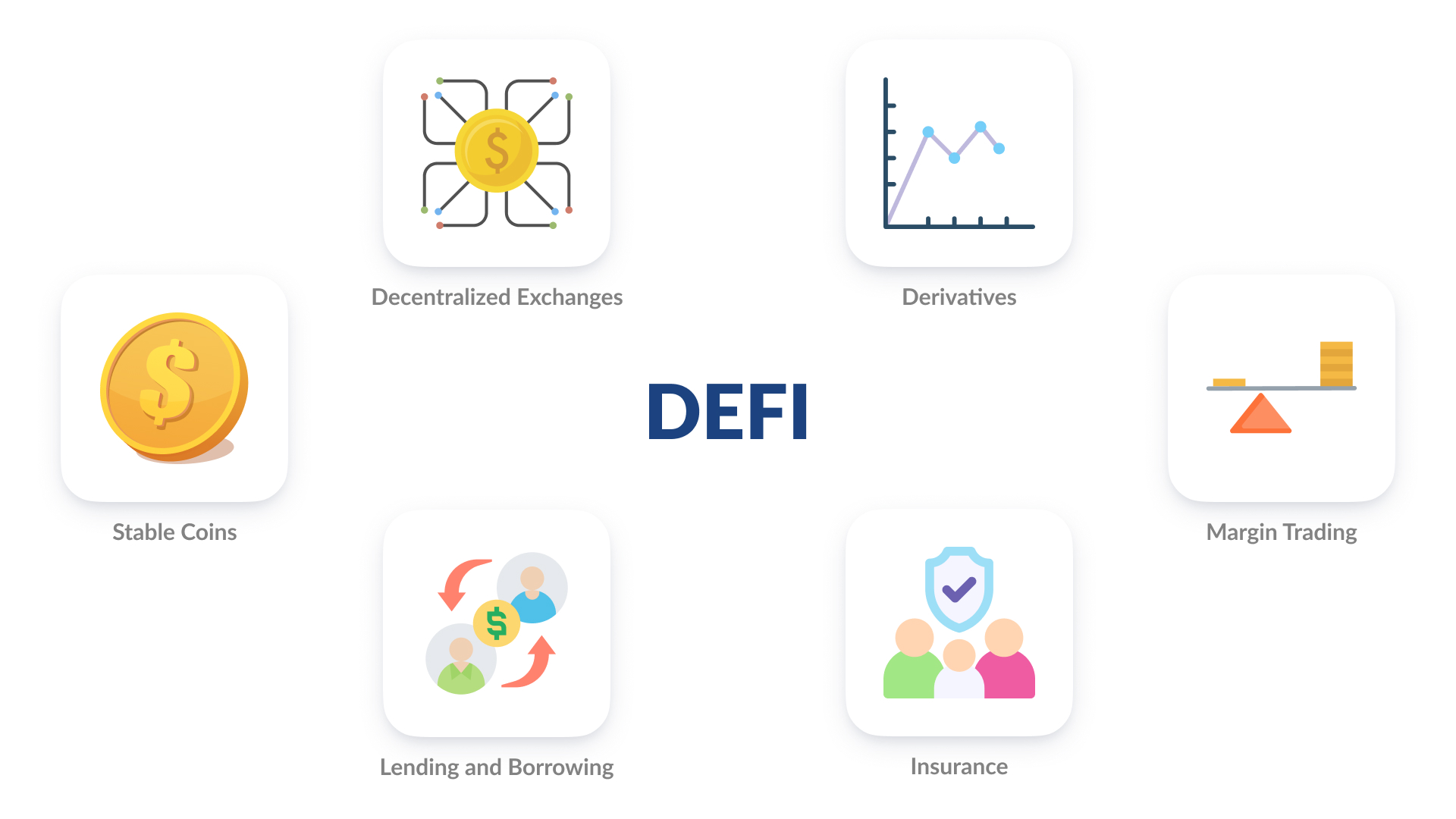

Thanks to the application of self-executed smart contracts, cryptography and blockchain, DeFi apps can offer much more possibilities to users, including lending, trading, insurance services among others. And all this is available to a wide audience without the necessity to rely on third-party intermediaries like banks.

Key benefits of DeFi

According to the information provided by the World Bank in 2018, 1.7 billion adult people remained unbanked in 2017 and it is obvious that the situation hasn’t changed drastically since then. An impressive number of people still do not have access to traditional banking services. But this issue can be easily solved with the help of DeFi apps.

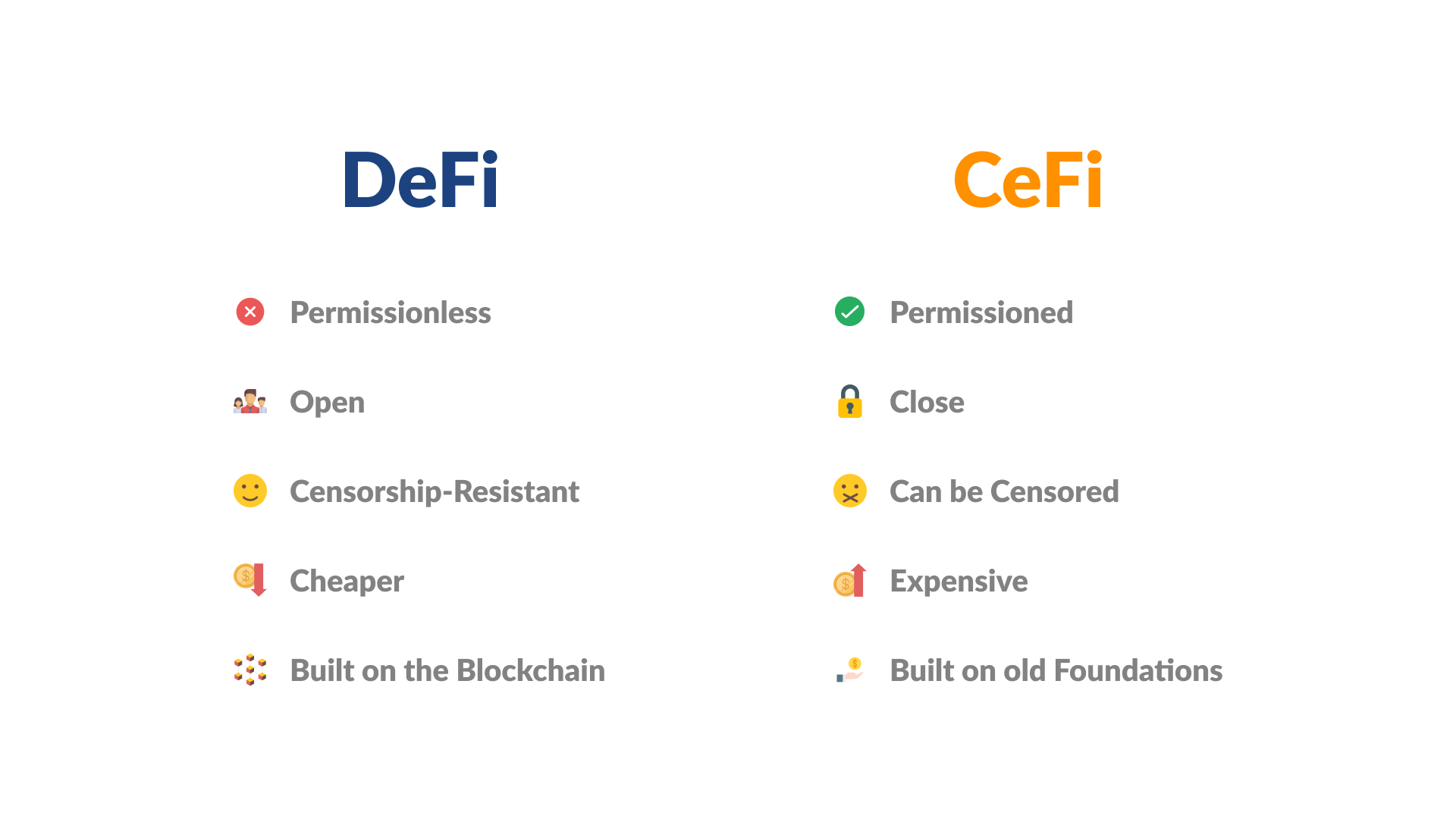

While the CeFi (centralized finance) space is a closed and expensive system that is built on old foundations, DeFi is a breath of fresh air with its cheaper transactions and wider availability. The list of benefits of this approach to finance is really quite long. Let’s focus on the core ones.

- DeFi is permissionless. You do not need to rely on any corporations and organizations that are responsible for storing your data, providing server space or conducting control. Just bear in mind that DeFi apps run on blockchain networks that keep all transaction history. Public (permissionless) blockchains such as Ethereum are highly decentralized and accessible to anyone.

- DeFi ensures full transparency. This advantage is also explained by the nature of blockchain and the distributed ledger technology (DLT). All the information about the activities on the network is recorded and can’t be altered. The data is available to the public. For both companies and customers, it can be a very important point. With this transparency, it has become much easier to detect potential fraud and scams and to avoid harmful business practices and financial losses.

- DeFi provides permanent and quick access to low-cost services. DeFi services are available 24/7 regardless of national holidays, days-off and other things of this type. They are available without visiting banks or offices of financial companies, so, it doesn’t matter where you are when you decide to use your DeFi app (the only pre-condition is an internet connection). Without wasting much time, you can send money to your friend or get a loan making just one click.

So, have you already guessed why DeFi is expected to become the future of the financial world? DeFi makes everything faster, cheaper, more reliable and available. Isn’t it exactly what we all are trying to achieve?

Our developers can help you to wow the market with innovative turnkey solutions built on top of one of the most popular protocols like Ethereum, Binance Smart Chain (BSC), Hyperledger Fabric and Tendermint. Our DeFi apps can address a wide range of your business tasks and only your imagination is a limit here. Let’s shape the future for our world together! Please, feel free to contact us to share your ideas.